Savings Rate Over or Under 3%?

When it comes to savings rate, we want to compete with the best! Savings rate is one data point we love tracking to make sure we’re striding in the direction of financial independence.

Here’s a fun fact about me. I’m a bit of a stat nerd, and I’m probably too competitive. OK, so that’s two fun facts. Truthfully, both Jessie and I take games a bit too seriously, me especially when I start to lose. I HATE LOSING!!! If I’m interested enough to join in, I sure as heck don’t want to lose! Now don’t confuse that with being a sore loser. Here’s some honest self awareness, my grace in losing directly corresponds with how graciously the winner wins. Probably something I need to work on a bit, but I’m still growing up. Lol.

Our Metrics

Anyway, one of the metrics Jessie and I have been tracking is our savings rate. It started towards the beginning of our debt free journey 3 years ago when I read The Shockingly Simple Math Behind Early Retirement written by Mr. Money Mustache. This article breaks down the math behind how savings rate impacts your timeline to FI, and it really is shockingly simple. Imagine that. We wanted to start tracking our saving rate so that we a rough estimate of when we could be financially independent if we kept our current living style.

National Savings Rate

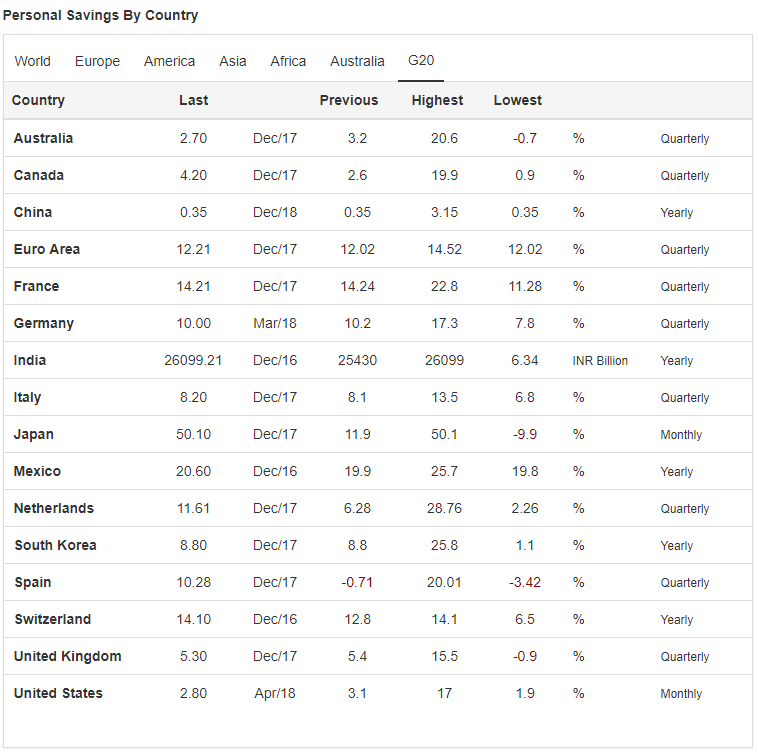

Before I talk about our savings rate, I feel it’s import to give some statics to measure against. I know it’s pretty awesome to a track savings rate while comparing it to a potential early retirement, but it’s way better to also have someone to compete against! Again, I love competition! In this case, we thought comparing our savings rate against the national savings rate would be a great idea. I started doing some research to find the national savings rate, and what I found stunned me for a second. The current U.S personal savings rate is at a 2.8% according to Trading Economics updated in April 2018. I couldn’t believe it…a 2.8%!! Well shoot, that’s not going to be hard to beat. Can we get some competition here for goodness sake?! Of the G20, the U.S. is ranked number 17 for those of you keeping score, because I certainly am.

Our Savings Rate

I’ll start by saying this, until I was in my 30’s, my personal savings rate was precisely 0%. I was saving exactly nothing! I was completely oblivious to saving money, let alone tracking it, and Jessie wasn’t much better. Frugal…yes. Savers? Definitely not. We eventually did educate ourselves, and are now aware of our savings rate. It’s something we can’t pretend we didn’t see after we became aware of it.

Now, I know this may come off as a humble, or not so humble, brag and I’m fine with either. Year to date, Jessie and I are holding a 66.1% savings rate. Substantially better than the measly 2.8% the U.S. average is currently posting on the scoreboard. Quite honestly, we didn’t have to do much more than gain a bit of awareness about where we spend our money to hit a 50% savings rate. It took a combination of budget magic, expense chopping and learning how to say no to find the last 16%. We hit anywhere between, 60%-65% regularly without cramping our lifestyle. We aren’t eating Ramen Noodles and wearing rags for clothing.

A Call to Action

2.8% is saving something, but it’s not even close to what would be needed to retire. Lets just call it what is. It’s a poor number especially when we’re looking at consumer spending increasing year over year. Let me ask this flat out… Are you truly unable to save even 1% more than you are now? On a 50k/year salary, that’s a little less than $42 a month. Are you asking how you could possibly save $42 more a month?

- • Eat out one less time

- • Save one tank of gas by walking a little more

- • Sell something in your house that you don’t need

- • Cut back cable and read a book

- • Payoff a debt that will save you $42 a month in payments

- • Cancel an unused gym membership, and workout around the house

- • Review your budget to cut back

There’s also a flip side to cutting back expenses. You could increase your income and SAVE ALL OF THE INCOME!!! That’ll increase your savings rate for sure! Here are a few things you can do to get your side hustle on….

- • Cut Grass

- • Dog walker

- • Virtual Assistant

- • Sell Items online

- • Get a part time job

- • Tutor in a particular skill you have

- • Create something to sell

How to calculate savings rate:

Here’s a quick way of figuring out your saving rate.

Add everything you save including…

- • Savings accounts for an emergency, vacation, new car etc….

- • Any investment account such as, retirement account, taxable accounts, employer contribution, HSA

…and divide it by your total take home pay. That’ll give you your savings rate.

Pretty simple right? Give it a shot. Review your previous 2 months and calculate what you’ve saved, and then refer back to MMM’s post to see how long you will have to work before you can retire. Ask yourself if you’ll be happy working that many more years.

We post our monthly savings rate on Instagram, so please don’t be afraid to come share your savings rate with us. You know we love FRIENDLY competition!! All jokes aside, we’d love to walk with you as you grow that number!