Travel Hacking pt 3: An Inside Look at Our Process

I’m going to take you on a walk through what the application of this looks like in our life. I know from first hand experience that reading about this and getting excited is easy, but putting it into practice is scary as hell. I’m hoping that walking you through our process will take the scary out of it. Let’s get started.

Starting Point

There’s a great article over on ChooseFI regarding the Chase Gauntlet. This is exactly where Jessie and I started our travel credit cards. Why? Chase Ultimate Rewards are just that; Ultimate Rewards, They transfer to dozens of airlines and hotels worldwide. Having these points allows us to have our pick of airlines or hotels to stay. If we get A Hilton card, we’re limited to Hilton. So, our first card was the Chase Sapphire Preferred card. We picked this card because it had a great bonus an small annual fee. Also, a spending limit we were comfortable hitting, which was $4,000 within 3 months of opening the card.

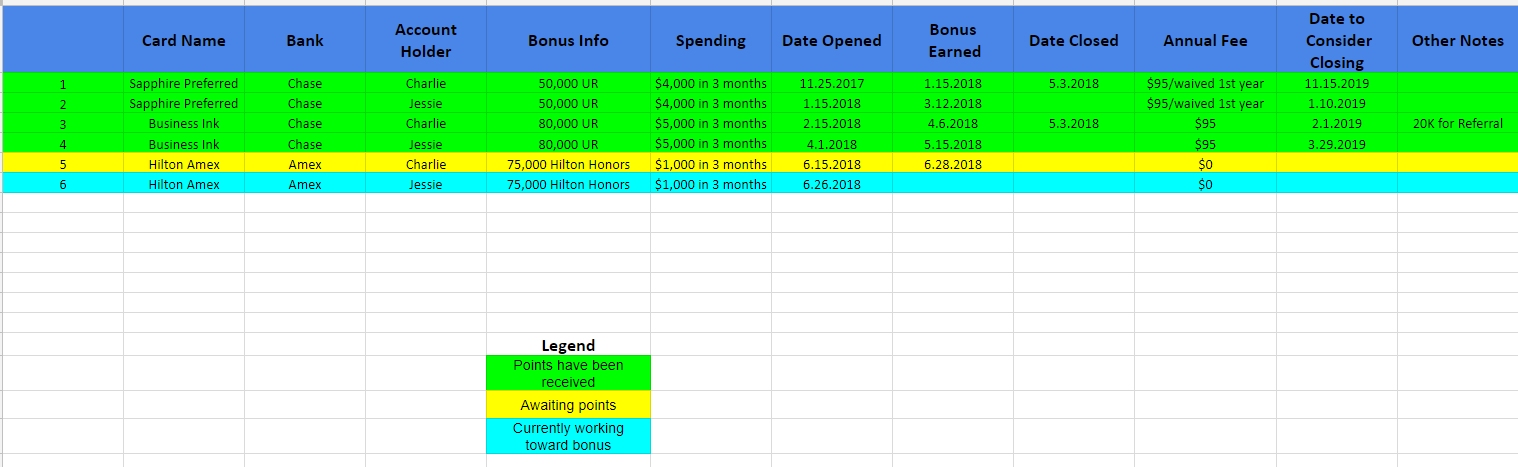

The first card was in my name, and once we hit the bonus, we opened the same card in Jessie’s name. As you can see in our spreadsheet below, we moved right through the Chase cards. If you compare the cards we’ve opened against the list at ChooseFI, you’ll notice some are missing from our list. We skipped the Chase Sapphire Reserve due to the high annual fee ($495). The Reserve card offers great incentives that offset the annual fee, but Jessie and I couldn’t pull the trigger. That big ticket annual fee scares me. LOL. Maybe we will once we start running out of cards to open.

You may notice that we haven’t opened the Southwest cards that I spoke about in part 2. We’re holding out on that because we want to hit the bonus for that early in 2019 so that we can travel with the companion pass for all of 2019 and 2020.

Accumulation Phase

So, in this phase we are opening a card hitting the bonus, and then deciding whether or not to close the card based upon what the impact on your points would be. Jessie always has the Chase Sapphire open and I always keep the Chase Freedom card open for a couple of reasons.

1. The Sapphire is a great travel card. No foreign transaction fees, includes travel insurance, covers rental car insurance even though it includes a $95 annual fee. (waived the first year)

2. The Chase Freedom allows you to accumulate Ultimate Rewards points without an annual fee, BUT it doesn’t allow you to transfer the points directly to travel partners. The Sapphire does.

3. Allows us to transfer the points from my Chase Freedom to Jessie’s Chase Sapphire so that we can still transfer directly to travel partners.

This gives us the ability to earn Ultimate Rewards on two cards while only paying one fee. Combining points through the chase rewards website is very easy. It takes only a few clicks to instantly transfer points from one account to another.

Redemption Phase

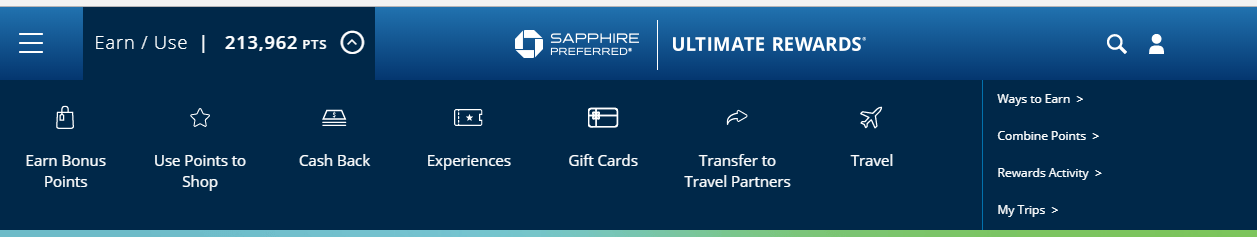

Finally, the moment we’ve all been waiting for. Redeeming these points for free travel. Jessie and I have just recently entered into the redemption phase. So, we are going to pass along examples of what we are doing. We’ve transferred some points from the Chase Rewards Portal directly to our southwest account along the way. We redeemed the points for flights back to Pittsburgh to see our family. Those points redeemed at a rate of 1.5 cents per point. A pretty good rate resulting in a free flight home.

A good redemption rate is roughly 1.5 cents per point. If you apply the 1.5 cents per point to the 280,000 points we’ve received from chase, we’ve accumulated $4,200 in free travel money! People in the travel hack space consider 2 cents per point the sweet spot. At that rate, that’s $5,600!!! Not too shabby for an hour our work per month. A very nice pay raise for 5 months of accumulating points.

Our redemption process looks like this:

1. Shop airline or hotel websites for their current cost in currency and points to find the best deal

2. Once you find the best deal login to the chase rewards portal

3. Transfer points needed to your airline or hotel account

4. Wait 60 seconds for points to show up in your airline or hotel account

5. Sign back into airline or hotel site

6. Book the itinerary with the points

It’s that easy.

Screenshots

Here are some screenshots so that you can see how simple this can be.

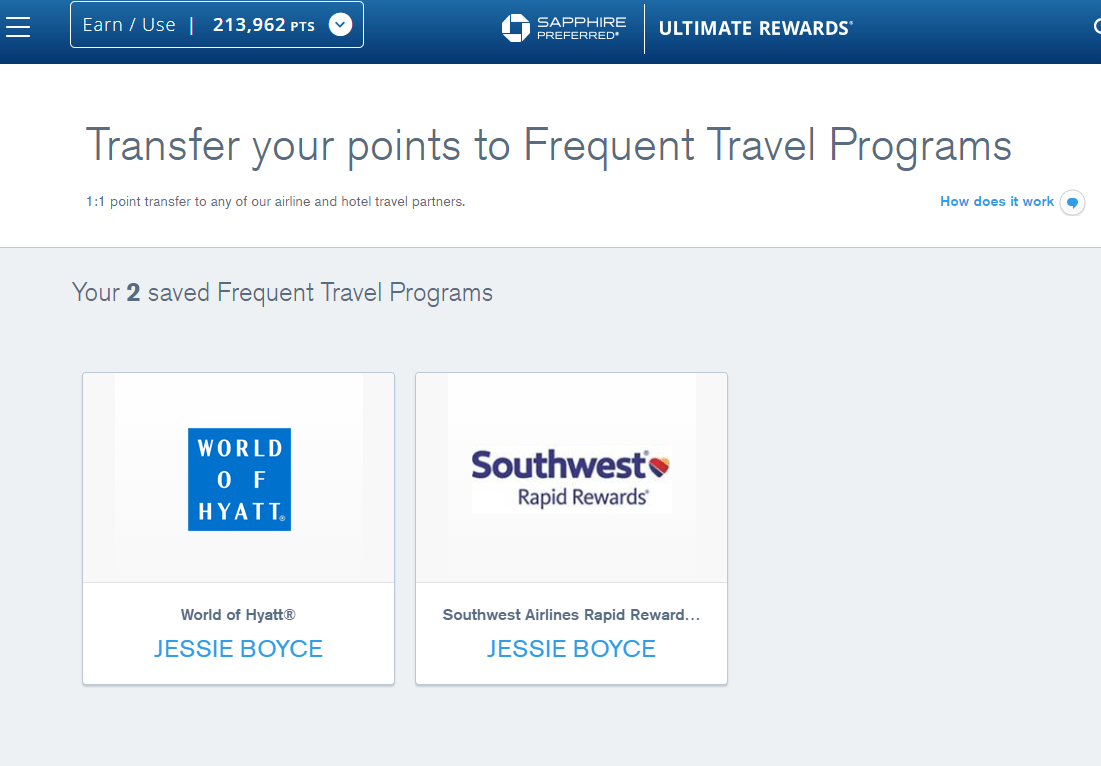

When you click on “transfer to travel partners”, it’ll bring you to this screen…

Here you can add your frequent travel programs that will allow you to easily click and transfer points to that partner. The points transfer over almost instantly. So if you transfer 10,000 points to Southwest, it may take 60 seconds before they will appear in your Southwest account.

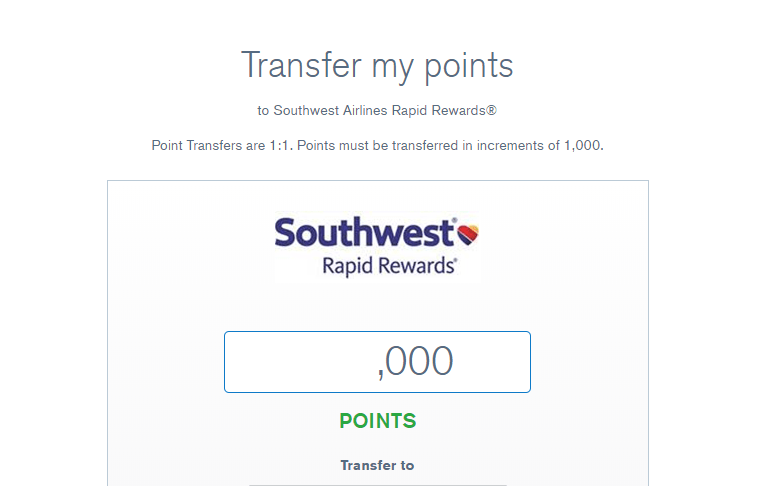

Once you click on the Travel Partner you want to transfer points to, you’ll see this screen….

You can even book travel right through the Chase Rewards site. The redemption value isn’t as good, but it does make it easy. It looks like this…..

Our Examples

We just got more complex recently. We are traveling to New Orleans for Christmas. Jessie and I are both huge Pittsburgh Steelers fans. So, we’ve recently decided to travel to a city we’ve never been each year to attend a Steelers game. This year is New Orleans!

We booked a 4 night stay at a Hyatt right near the famous Bourbon street and 2 round trip Southwest flights for a total of $22.40. The $22.40 is a tax on the flight that can’t be paid with points. We did this by shopping hotels and finding out what their points per night rate was. Hyatt’s points per night allowed us to redeem at 2.78 cent per point.

We also booked a trip to San Francisco in January 2019 for our cousin’s wedding. A 4-night stay in a Hyatt in Fisherman’s Wharf plus 2 round trip tickets from Tampa. Total cost = $22.40!

Recap, we are taking two 4 day vacations including airfare and hotel for a total of $44.80. It would have cost $2,880.82 if we had paid for these trips outright. Would that be a trip you’d take for that cost? Guess what? YOU CAN!!!

In Closing

I know we’ve focused on the Chase cards in these posts, but just about every airline and hotel has their own cards with their own bonuses. That’s the beauty of travel hacking; you have plenty of cards to choose from. I focused on Chase in this post because they are a simple starting point. Travel hacking is very simple. It doesn’t take a genius or someone with hours of free time each day. Like any other money habit, it takes conscious decisions and discipline. If you can do that, then you can enjoy a life of practically free travel RIGHT NOW!!!

Please reach out to us with questions! Jessie and I love meeting new people and helping others live an abundant life.

Sign up below (if you’re not already a part of our community) to make sure you don’t miss the rest of this series!