Travel Hacking pt 4: Resources and Words of Wisdom

I’m going to impart on you some words of wisdom we learned by making mistakes along the way. Below are some great resources to help you get started travel hacking! Please have fun, see the world, learn something, and make good financial decisions. Also, IF YOU HAVE QUESTIONS PLEASE ASK!! WE LOVE TALKING TO YOU ALL!

Words of Wisdom

1. Pay attention to Chase’s 5/24 rule. It a rule that Chase has put in place to prevent too many rewards to the same person. Chase strictly enforces this. They pay attention to what account you open with other providers as well. Not all other accounts and cards account against this rule. Which accounts apply to this rule is ever changing so please look into it before deciding to open the account. I recommend prioritizing getting Ultimate Rewards from Chase

2. Watch your credit score. Jessie and I’ve had our scores fluctuate with 15-20 points as we open and close cards. Our scores were in the 800’s so we weren’t worried about 15-20 points when the rewards totally outweigh the scores dipping a bit.

3. Track your cards. Use our spreadsheet from this post as a template if you’d like.

4. Take it slow. If you’re going after the Chase Ultimate Rewards, you can only open 5/24 anyway. Don’t overwhelm yourself.

5. Ask questions. Ask us questions please. We’re here to help. If we don’t have the answer, we can find it together.

This gives us the ability to earn Ultimate Rewards on two cards while only paying one fee. Combining points through the chase rewards website is very easy. It takes only a few clicks to instantly transfer points from one account to another.

Here are some great resources we use to help us in the journey

The guys (Brad and Jonathan) over at ChooseFI do an outstanding job of explaining travel rewards in their travel rewards series. Also, they have great podcasts on the topic. Episode 009 & Episode 31

The Mad FIentist and Nerdwallet have put together some amazing tools for locating the best travel cards available.

Award Wallet is a great tools for keeping track of all of your award points.

Debitize is an outstanding tool. It allows you to turn your credit card into a debit card some that you never forget to pay. It takes the money out of you spend out of your checking each day and pays your credit card bill.

Our redemption process looks like this:

1. Shop airline or hotel websites for their current cost in currency and points to find the best deal

2. Once you find the best deal login to the chase rewards portal

3. Transfer points needed to your airline or hotel account

4. Wait 60 seconds for points to show up in your airline or hotel account

5. Sign back into airline or hotel site

6. Book the itinerary with the points

It’s that easy.

Screenshots

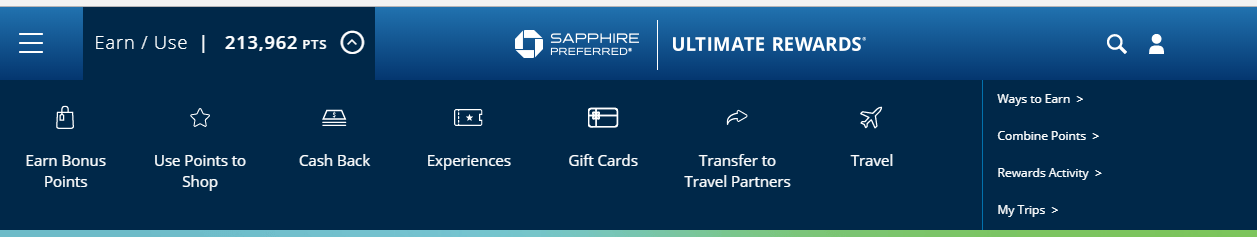

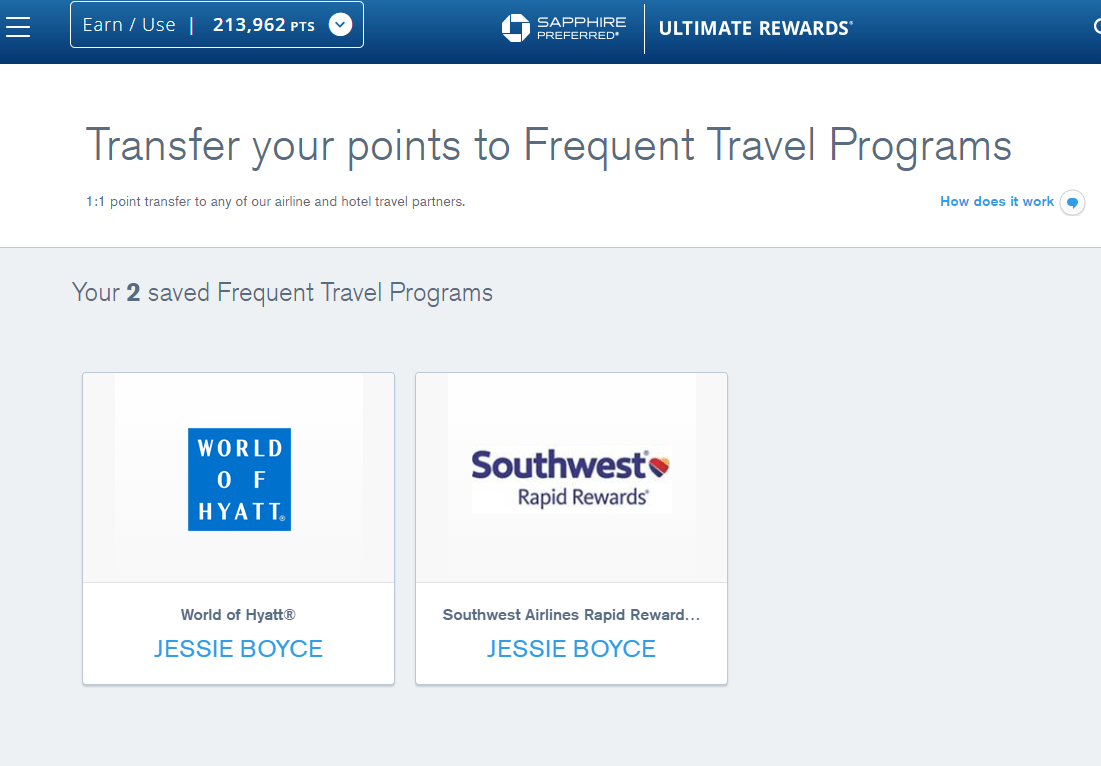

Here are some screenshots so that you can see how simple this can be.

When you click on “transfer to travel partners”, it’ll bring you to this screen…

Here you can add your frequent travel programs that will allow you to easily click and transfer points to that partner. The points transfer over almost instantly. So if you transfer 10,000 points to Southwest, it may take 60 seconds before they will appear in your Southwest account.

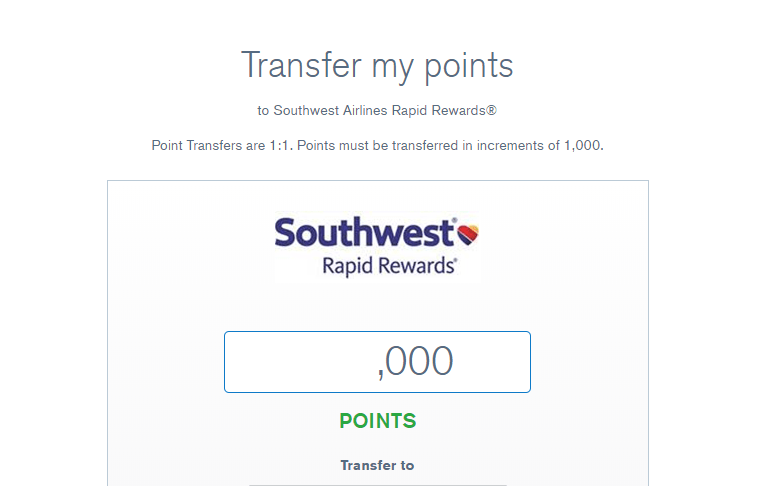

Once you click on the Travel Partner you want to transfer points to, you’ll see this screen….

You can even book travel right through the Chase Rewards site. The redemption value isn’t as good, but it does make it easy. It looks like this…..

Our Examples

We just got more complex recently. We are traveling to New Orleans for Christmas. Jessie and I are both huge Pittsburgh Steelers fans. So, we’ve recently decided to travel to a city we’ve never been each year to attend a Steelers game. This year is New Orleans!

We booked a 4 night stay at a Hyatt right near the famous Bourbon street and 2 round trip Southwest flights for a total of $22.40. The $22.40 is a tax on the flight that can’t be paid with points. We did this by shopping hotels and finding out what their points per night rate was. Hyatt’s points per night allowed us to redeem at 2.78 cent per point.

We also booked a trip to San Francisco in January 2019 for our cousin’s wedding. A 4-night stay in a Hyatt in Fisherman’s Wharf plus 2 round trip tickets from Tampa. Total cost = $22.40!

Recap, we are taking two 4 day vacations including airfare and hotel for a total of $44.80. It would have cost $2,880.82 if we had paid for these trips outright. Would that be a trip you’d take for that cost? Guess what? YOU CAN!!!

In Closing

I know we’ve focused on the Chase cards in these posts, but just about every airline and hotel has their own cards with their own bonuses. That’s the beauty of travel hacking; you have plenty of cards to choose from. I focused on Chase in this post because they are a simple starting point. Travel hacking is very simple. It doesn’t take a genius or someone with hours of free time each day. Like any other money habit, it takes conscious decisions and discipline. If you can do that, then you can enjoy a life of practically free travel RIGHT NOW!!!

Please reach out to us with questions! Jessie and I love meeting new people and helping others live an abundant life.

Sign up below (if you’re not already a part of our community) to make sure you don’t miss the rest of this series!